Need to calculate income tax as well? Try our PAYE calculator.

The Goods and Services Tax (GST) in New Zealand is a comprehensive value-added tax applied to most products and services. Introduced in 1986 by the Fourth Labour Government, GST initially had a rate of 12.5%. In 2010, the National government increased this rate to 15%. This tax, primarily managed by the Inland Revenue Department, is usually filed every one, two, or six months, depending on the business's preference.

GST Registration and Returns for NZ Businesses

For businesses operating in New Zealand, registering for GST with the IRD is mandatory when the turnover exceeds $60,000. However, businesses with lower turnovers can opt for voluntary registration. GST registration is crucial, especially for businesses exporting goods and services, as they can zero-rate their exports. This means they charge GST at a 0% rate, allowing them to claim back the input GST on their returns. It's important to note that businesses providing GST-exempt supplies cannot claim back input GST.

Impact of GST on Business Operations

Understanding the base sales price excluding GST is essential for businesses, as it allows them to calculate the net GST they need to pay or claim back. The shift to a 15% GST rate has implications for cash flow, affecting how businesses manage their finances. Wholesalers, for example, often display prices without GST but charge the total amount, including tax, at the point of sale.

Simple Guide to Calculating GST in New Zealand

Calculating GST in New Zealand remains straightforward despite the rate change. The calculation is based on the 'base' value - the price excluding GST for adding GST, or the total price including GST for determining the tax component. For simplicity, let's consider a base value of $100 in our examples. This approach helps in understanding the process of calculating GST for different scenarios.

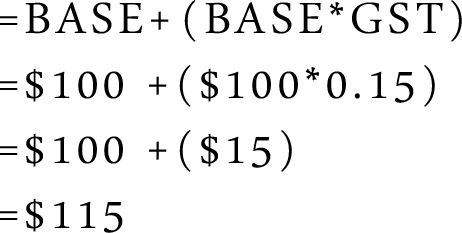

Addition of GST:

In the example you see below, we have started with a base figure of $100. Given that the rate of GST that we are using is 15% (which is written as 0.15 as a decimal) we can see that in this example we have the base ($100) and to that we have to add the GST of the original amount which in this case is (15% of $100). From that point, all we have to do is add the new found GST content ($15) to the base figure ($100) to get the new GST inclusive figure of $115.

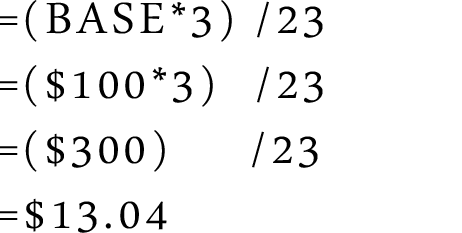

Finding GST Content:

In the example below, we can see that this calculation is slightly harder, but using the formula can be found quite easily. The base in this example is $100 again. Firstly we can see that overall the formula is GST Content =((BASE*3)/23) which on $100 is $13.04.

Here is an additional GST calculation example using real New Zealand GST incurring transactions.

GST Calculation Example 1: Andrew runs a small business doing building work, and during January he spent four weeks working on four different projects. These projects were for his building service only and did not include the supply of the building materials to do the job. In this example, we will calculate how much GST Andrew has collected during the period via the business contracting work.

In the first week, Andrew worked for $70 + GST per hour, for 50 hours. In the second week, Andrew worked for $85 + GST per hour, for 40 hours. In the third week, he worked for $75 + GST per hour for 45 hours, and in the last week, he worked for $70 + GST for 25 hours.

Week 1: $70.00 * 50 = $3,500 GST exclusive sub-total. GST exclusive sub-total $3,500 * 0.15 (15% GST rate) = $525.00, which is the GST content.. Adding those together the GST-inclusive total for the week = $4,025.00.

Week 2: $85.00 * 40 = $3,400 GST exclusive sub-total. GST exclusive sub-total $3,400 * 0.15 (15% GST rate) = $510.00, which is the GST content. Adding those together the GST-inclusive total for the week = $3,910.00.

Week 3: $75.00 * 45 = $3,375 GST exclusive sub-total. GST exclusive sub-total $3,375 * 0.15 (15% GST rate) = $506.25, which is the GST content. Adding those together the GST-inclusive total for the week = $3,881.25.

Week 4: $70.00 * 25 = $1,750 GST exclusive sub-total. GST exclusive sub-total $1,750 * 0.15 (15% GST rate) = $262.50, which is the GST content. Adding those together the GST-inclusive total for the week = $2,012.50.

Month Total = $12,025 GST exclusive sub-total. GST exclusive sub-total $12,025.00 * 0.15 (15% GST rate) = $1,803.75, which is the GST content. Adding those together the GST-inclusive total for the week = $13,828.75.

In this example, Andrew has collected through the sale of services $1,803.75 worth of GST which is the tax on the supply (sale) of the services that Andrew has undertaken in the period. If Andrew has a monthly GST return filing frequency, then that value would be the GST collected total. NOTE: Andrew would likely have purchases such as fuel and other services needed to complete this work which he may be eligible to offset this collected total via the GST that he has paid for the associated purchases and business expenses.

In the first week, Susan worked for $80 + GST per hour, for 30 hours. In the second week, Susan worked for $95 + GST per hour, for 35 hours. In the third week, she worked for $85 + GST per hour for 40 hours, and in the last week, she worked for $90 + GST for 20 hours.

Week 1: $80.00 * 30 = $2,400 GST exclusive sub-total. GST exclusive sub-total $2,400 * 0.15 (15% GST rate) = $360.00, which is the GST content. Adding those together the GST-inclusive total for the week = $2,760.00.

Week 2: $95.00 * 35 = $3,325 GST exclusive sub-total. GST exclusive sub-total $3,325 * 0.15 (15% GST rate) = $498.75, which is the GST content. Adding those together the GST-inclusive total for the week = $3,823.75.

Week 3: $85.00 * 40 = $3,400 GST exclusive sub-total. GST exclusive sub-total $3,400 * 0.15 (15% GST rate) = $510.00, which is the GST content. Adding those together the GST-inclusive total for the week = $3,910.00.

Week 4: $90.00 * 20 = $1,800 GST exclusive sub-total. GST exclusive sub-total $1,800 * 0.15 (15% GST rate) = $270.00, which is the GST content. Adding those together the GST-inclusive total for the week = $2,070.00.

Month Total = $10,925 GST exclusive sub-total. GST exclusive sub-total $10,925.00 * 0.15 (15% GST rate) = $1,638.75, which is the GST content. Adding those together the GST-inclusive total for the month = $12,563.75.

In this example, Susan has collected through the sale of services $1,638.75 worth of GST, which is the tax on the supply (sale) of the services that Susan has undertaken in the period. If Susan has a monthly GST return filing frequency, then that value would be the GST collected total. NOTE: Susan would likely have purchases such as software licenses and other services needed to complete this work, which she may be eligible to offset this collected total via the GST that she has paid for the associated purchases and business expenses.

GST Calculation Example 3: John runs a medium-sized construction company in New Zealand and during April, he spent four weeks working on four different projects. These projects included both labour and the supply of building materials. In this example, we will calculate how much GST John has collected during the period via the business contracting work, as well as how much GST was spent on necessary materials, using the New Zealand GST rate of 15%.

Project 1: Constructing a residential home - Labour: $50,000 + GST; Building materials: $150,000 + GST

Project 1 Labour: $50,000 * 0.15 (15% GST rate) = $7,500 GST content. GST-inclusive total = $57,500.

Project 1 Materials: $150,000 * 0.15 (15% GST rate) = $22,500 GST content. GST-inclusive total = $172,500.

Project 2: Renovating an office space - Labour: $25,000 + GST; Building materials: $75,000 + GST

Project 2 Labour: $25,000 * 0.15 (15% GST rate) = $3,750 GST content. GST-inclusive total = $28,750.

Project 2 Materials: $75,000 * 0.15 (15% GST rate) = $11,250 GST content. GST-inclusive total = $86,250.

Project 3: Repairing a warehouse roof - Labour: $15,000 + GST; Building materials: $35,000 + GST

Project 3 Labour: $15,000 * 0.15 (15% GST rate) = $2,250 GST content. GST-inclusive total = $17,250.

Project 3 Materials: $35,000 * 0.15 (15% GST rate) = $5,250 GST content. GST-inclusive total = $40,250.

Project 4: Building a garden shed - Labour: $5,000 + GST; Building materials: $10,000 + GST

Project 4 Labour: $5,000 * 0.15 (15% GST rate) = $750 GST content. GST-inclusive total = $5,750.

Project 4 Materials: $10,000 * 0.15 (15% GST rate) = $1,500 GST content. GST-inclusive total = $11,500.

Month Total Labour = $95,000 GST exclusive sub-total. GST exclusive sub-total $95,000 * 0.15 (15% GST rate) = $14,250, which is the GST content. Adding those together, the GST-inclusive total for labour = $109,250.

Month Total Materials = $270,000 GST exclusive sub-total. GST exclusive sub-total $270,000 * 0.15 (15% GST rate) = $40,500, which is the GST content. Adding those together, the GST-inclusive total for materials = $310,500.

In this example, John has collected through the sale of services and materials $54,750 worth of GST ($14,250 from labour and $40,500 from materials), which is the tax on the supply (sale) of the services and materials that John has undertaken in the period. If John has a monthly GST return filing frequency, then that value would be the GST collected total.

During the same period, John spent the following amounts on purchasing necessary items to complete the projects:

Equipment Rental: $20,000 * 0.15 (15% GST rate) = $3,000 GST content. GST-inclusive total = $23,000.

Fuel for vehicles: $5,000 * 0.15 (15% GST rate) = $750 GST content. GST-inclusive total = $5,750.

Office supplies: $1,000 * 0.15 (15% GST rate) = $150 GST content. GST-inclusive total = $1,150.

Month Total Expenses = $26,000 GST exclusive sub-total.

GST exclusive sub-total $26,000 * 0.15 (15% GST rate) = $3,900, which is the GST content. Adding those together, the GST-inclusive total for expenses = $29,900.

In this example, John has paid $3,900 worth of GST on the necessary items to complete the projects. This amount can be offset against the $54,750 GST collected total to determine the net GST payable.

Net GST Payable = GST Collected - GST Paid on Expenses Net GST Payable = $54,750 - $3,900 = $50,850

In this more detailed example, John has a net GST payable of $50,850 for the period. This is the amount of GST he is required to remit to the New Zealand IRD when he files his monthly GST return. By providing a more elaborate breakdown of labour, materials, and expenses, this example showcases a more comprehensive approach to calculating NZ GST for a construction company, accounting for both GST collected and spent on items needed to complete the job.

GST Calculation Example 4: Tim is a private fisherman who sells his high quality Snapper catch to various local seafood restaurants in the coatal town on Paihia. In December, he completed several deliveries to his clients but did not receive any payments from them in that month. He did, however, incur costs for the services needed to run his fishing operation during December. In this example, we will calculate Tim's GST obligations for December, considering the unpaid sales and the expenses incurred.

Sales:

Week 1: 3,000 kg of fish * $15/kg = $45,000

Week 2: 2,500 kg of fish * $15/kg = $37,500

Week 3: 4,000 kg of fish * $15/kg = $60,000

Week 4: 3,500 kg of fish * $15/kg = $52,500 Total Sales (GST-exclusive): $195,000

Tim did not receive any payments for his sales in December, so his GST collected for the month is $0.

Expenses:

Boat fuel: $12,000 * 0.15 (15% GST rate) = $1,800 GST content. GST-inclusive total = $13,800.

Fishing gear maintenance: $8,000 * 0.15 (15% GST rate) = $1,200 GST content. GST-inclusive total = $9,200.

Bait: $6,000 * 0.15 (15% GST rate) = $900 GST content. GST-inclusive total = $6,900.

Month Total Expenses = $26,000 GST-exclusive sub-total. GST-exclusive sub-total $26,000 * 0.15 (15% GST rate) = $3,900, which is the GST content. Adding those together, the GST-inclusive total for expenses = $29,900.

In this example, Tim has paid $3,900 worth of GST on the necessary items to run his fishing operation in December. Since he did not receive any payments for his sales, his GST collected total for the month is $0. As a result, Tim has a net GST credit for December.

Net GST Credit = GST Collected - GST Paid on Expenses Net GST Credit = $0 - $3,900 = -$3,900

In this case, Tim has a net GST credit of $3,900 for the period. This means he can claim a refund when he files his monthly GST return with the IRD. This example demonstrates how a business that makes sales but does not receive payment in a given month can still account for GST paid on expenses incurred during that period.

GST Calculation Example 5: Sarah, an independent graphic designer in Wellington, New Zealand, had various clients and expenses in May. She invoiced her clients for design services and incurred several business-related expenses. In this example, we'll calculate Sarah's GST obligations for May, considering both the GST on her services and the GST on her expenses.

Sales (Services Provided):

Week 1: Branding project for a cafe - $4,000 + GST

Week 2: Website design for a local artist - $6,000 + GST

Week 3: Marketing material design for a charity event - $3,500 + GST

Week 4: Packaging design for a small business - $5,500 + GST Total Sales (GST-exclusive): $19,000

Each service incurs 15% GST, so:

Week 1 Service: $4,000 * 0.15 = $600 GST content. GST-inclusive total = $4,600.

Week 2 Service: $6,000 * 0.15 = $900 GST content. GST-inclusive total = $6,900.

Week 3 Service: $3,500 * 0.15 = $525 GST content. GST-inclusive total = $4,025.

Week 4 Service: $5,500 * 0.15 = $825 GST content. GST-inclusive total = $6,325.

Total GST Collected: $2,850 (Sum of GST contents for all services)

Expenses:

Computer software subscription: $300 * 0.15 (15% GST rate) = $45 GST content. GST-inclusive total = $345. Office rent: $1,200 * 0.15 (15% GST rate) = $180 GST content. GST-inclusive total = $1,380. Printing and materials: $700 * 0.15 (15% GST rate) = $105 GST content. GST-inclusive total = $805. Total Expenses (GST-exclusive): $2,200 Total GST Paid on Expenses: $330 (Sum of GST contents for all expenses)

Net GST Calculation:

Net GST Payable = GST Collected - GST Paid on Expenses Net GST Payable = $2,850 - $330 = $2,520

In this scenario, Sarah has a net GST payable of $2,520 for May. She collected $2,850 in GST through her design services but also paid $330 in GST on business-related expenses. This means, for her May operations, Sarah will need to remit $2,520 to the New Zealand Inland Revenue Department (IRD) as part of her GST return. This example highlights the importance for small business owners, like independent graphic designers, to accurately track both their income and expenses for effective GST management. Understanding these calculations helps ensure compliance with New Zealand's tax regulations and aids in maintaining a clear financial picture of the business.

Here are some examples of items that businesses in New Zealand would typically purchase, and be able to claim back GST:

This GST calculator for New Zealand makes it easy to calculate 15% GST for goods and services. It supports GST-inclusive and GST-exclusive amounts, applies custom GST rates, and is ideal for invoices, accounting, and GST returns. Use this tool to add GST, extract GST, or check the GST portion of any transaction. Trusted by New Zealand businesses, this calculator ensures accuracy for the current GST rate and historical rates like 12.5%. Whether you need a quick GST calculation or a full guide to GST in NZ, this tool helps you stay compliant and informed.

Below is a list of GST-related business purchases that are typically claimable in New Zealand. These phrases reflect common queries related to using a GST calculator for expenses and deductions:

If you've found a bug, or would like to contact us please click here.

Calculate.co.nz is partnered with Interest.co.nz for New Zealand's highest quality calculators and financial analysis.

© 2019–2025 Calculate.co.nz. All rights reserved.

All content on this website, including calculators, tools, source code, and design, is protected under the Copyright Act 1994 (New Zealand). No part of this site may be reproduced, copied, distributed, stored, or used in any form without prior written permission from the owner.

All calculators and tools are provided for educational and indicative purposes only and do not constitute financial advice.

Calculate.co.nz is part of the

realtor.co.nz,

GST Calculator,

GST.co.nz, and

PAYE Calculator group.

Calculate.co.nz is also partnered with

Health Based Building and

Premium Homes to promote informed choices that lead to better long-term outcomes for Kiwi households.